CHAPTER TWENTY-FOUR

MATH - SECTION 3 - Percentage Problems

SECTION 3 - Percentage Problems

• How do I work commission problems?

• What is meant by "seller's dollars after commission"?

• How do I determine interest?

• How do I determine monthly principal and interest payments?

• How do I work problems about points?

• How do I determine profit?

• What is the difference between appreciation and depreciation?

• How do I solve appreciation problems?

• How do l solve depreciation problems?

• How do I determine value for income-producing properties?

• How do I solve problems involving percentage leases?

► HOW DO I WORK COMMISSION PROBLEMS?

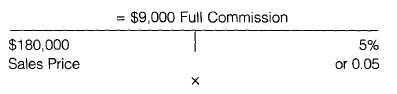

The full commission is a percentage of the sales price unless stated differently in the problem. Remember that full commission rates, commission splits between brokers, and commission splits between the broker and salespersons are always negotiable. Always read a problem carefully to determine the correct rate(s).

Full Commission

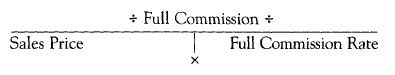

Sales Price x Full Commission Rate = Full Commission

Full Commission ÷ Full Commission Rate = Sales Price

Full Commission + Sales Price = Full Commission Rate

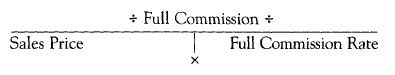

Broker's/Sales Person's Share of the Commission

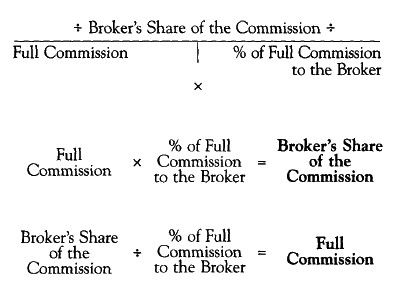

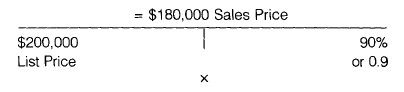

FOR EXAMPLE A seller listed a home for $200,000 and agreed to pay a full commission rate of 5 percent. The home sold 4 weeks later for 90 percent of the list price. The listing broker agreed to give the selling broker 50 percent of the commission. The listing broker paid the listing salesperson 50 percent of her share of the commission, and the selling broker paid the selling salesperson 60 percent of his share of the commission. How much commission did the selling salesperson receive?

$200,000 x 90% (.90) = $180,000

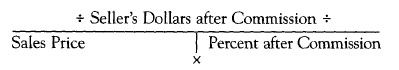

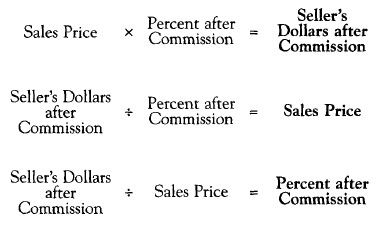

WHAT IS MEANT BY "SELLER'S DOLLARS AFTER COMMISSION"?

The first deduction from the sales price is the real estate commission. For example, if a house sold for $100,000 and a 7% commission was paid, that means $7,000 was paid in commissions. The seller still has 93% or $93,000. The seller's dollars after commission will be used to pay the seller's other expenses and hopefully will leave some money for the seller.

Seller's Dollars after Commission

Remember, the sales price is 100%. Thus 100% - Commission % = Percent after Commission.

FOR EXAMPLE After deducting $5,850 in closing costs and a 5 percent broker's commission, the sellers received their original cost of $175,000 plus a $4,400 profit. What was the sales price of the property?

$5,850 Closing Costs + $175,000 Original Cost + $4,400 Profit =

$185,250 Seller's Dollars after Commission

100% Sales Price — 5% Commission = 95% Percent after Commission

$185,250 + 95% (.95) = $195,000

$195,000 Sales Price is the answer.

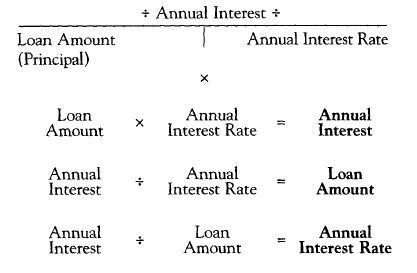

HOW DO I DETERMINE INTEREST?

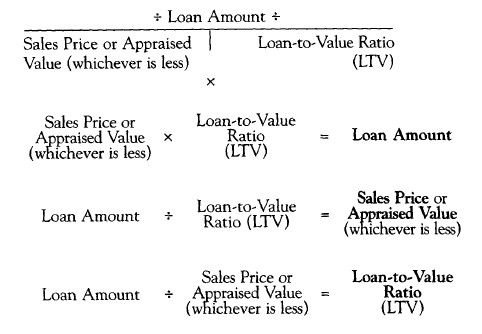

Interest is the cost of using money. The amount of interest paid is determined by the agreed-on annual interest rate, the amount of money borrowed (loan amount) or amount of money still owed (loan balance), and the period of time the money is held. When a lender grants a loan for real estate, the loan-to-value (LTV) ratio is the percentage of the sales price or appraised value, whichever is less, that the lender is willing to lend.

Remember – PART on top TOTAL and RATE on the bottom – In this case the Loan Amount will represent the PART that a lender is willing to loan of the Price or Value which is the TOTAL. The Loan to Value Ratio will be the RATE.

Again, following the T-Bar method of remembering – PART on top TOTAL and RATE on the bottom – In this case the Annual Interest will represent the PART of the Loan Amount loan which is the TOTAL. The Annual Interest Rate will be the RATE.

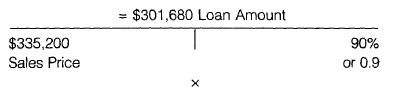

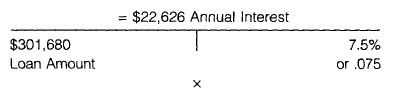

FOR EXAMPLE A parcel of real estate sold for $335,200. The lender granted a 90 percent loan at 7.5 percent for 30 years. The appraised value on this parcel was $335,500. How much interest is paid to the lender in the first monthly payment?

$335,200 x 90% (.90) = $301,680 Loan

$301,680 x 7.5% (.075) = $22,626

$22,626 Annual Interest ÷ 12 Months = $1,885.50 Monthly Interest

$1,885.50 Interest in the First Monthly Payment is the answer.

HOW DO I DETERMINE MONTHLY PRINCIPAL AND INTEREST PAYMENTS?

A loan payment factor can be used to calculate the monthly principal and interest (PI) payment on a loan. The factor represents the monthly principal and interest payment to amortize a $1,000 loan and is based on the annual interest rate and the term of the loan.

See Chapter 15 page 15-6 for an example of a loan factor chart.

Loan Amount ÷ $1,000 x Loan Payment Factor = Monthly PI Payment

Monthly PI Payment ÷ Loan Payment Factor = Loan Amount

FOR EXAMPLE If the lender in the previous example uses a loan payment factor of $6.99 per $1,000 of loan amount, what will be the monthly PI (principal and interest) payment?

$301,680 Loan Amount ÷ $1,000 x $6.99 = $2,108.74 Monthly PI Payment

$2,108.74 Monthly PI Payment is the answer.

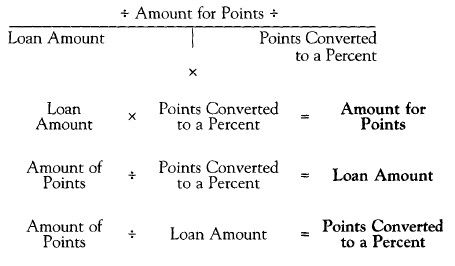

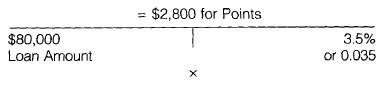

HOW DO I WORK PROBLEMS ABOUT POINTS?

One point equals 1 percent of the loan amount. Amount for Points

FOR EXAMPLE The lender will charge 3% loan discount points on an $80,000 loan?

What will be the total amount due?

$80,000 x 3.5% (.035) = $2,800

$2,800 for Points is the answer.

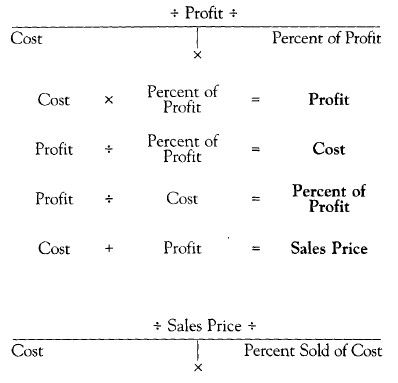

HOW DO I DETERMINE PROFIT?

A profit is made when we sell something for more than we paid for it. If we sell something for less than we paid, we have suffered a loss.

Sales Price - Cost = Profit

(100% Cost + % Profit = % Sales Price)

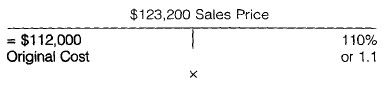

FOR EXAMPLE Your home listed for $125,000 and sold for $123,200, which gave you a 10 percent profit over the original cost. What was the original cost?

100% Original Cost + 10% Profit = 110% Sales Price

$123,200 + 110% (1.1) = $112,000

$112,000 Original Cost is the answer.

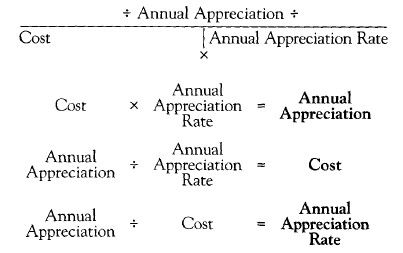

WHAT IS THE DIFFERENCE BETWEEN APPRECIATION AND DEPRECIATION?

Appreciation is increase in value. Depreciation is decrease in value. Both are based on the original cost. We only will cover the straight-line method, which is what should be used in math problems unless you are told differently. The straight-line method means that the value is increasing (appreciating) or decreasing (depreciating) the same amount each year. The amount of appreciation or depreciation is based on the original cost.

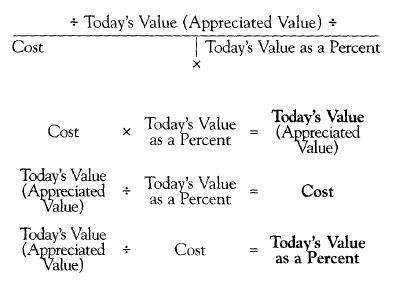

HOW DO I SOLVE APPRECIATION PROBLEMS?

Annual Appreciation Rate x Number of Years = Total Appreciation Rate

100% Cost + Total Appreciation Rate = Today's Value as a Percent

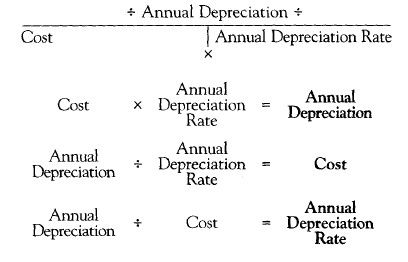

HOW DO I SOLVE DEPRECIATION PROBLEMS?

Annual Depreciation Rate x Number of Years = Total Depreciation Rate

100% Cost + Total Depreciation Rate = Today's Value as a Percent

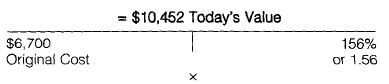

FOR EXAMPLE Seven years ago you purchased a piece of real estate for $93,700, including the original cost of the land, which was $6,700. What is the total value of the land today using an appreciation rate of 8 percent per year?

8% Appreciation per Year x 7 Years = 56% Total Appreciation Rate

100% cost + 56% Appreciation = 156% Today's Value

$6,700 x 156% (1.56) = $10,452

$10,452 Today's Value is the answer.

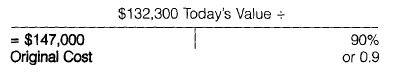

FOR EXAMPLE The value of a house without the lot at the end of four years is $132,300. What was the original cost of the house if the yearly rate of depreciation was 2.5 percent?

2.5% depreciation per year x 4 years = 10% total depreciation rate

100% cost - 10% depreciation = 90% today's value

$132,300 90% (.90) = $147,000

$147,000 Original Cost is the answer.

HOW DO I DETERMINE VALUE FOR INCOME-PRODUCING PROPERTIES?

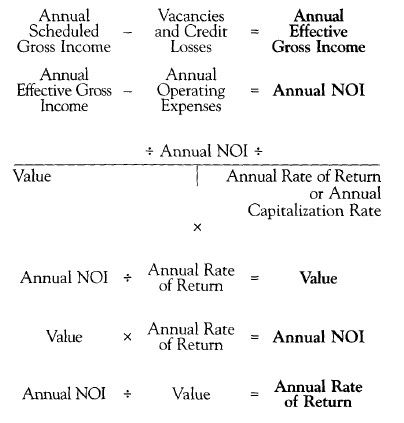

When appraising income-producing property, the value is determined by using the annual net operating income (NOI) and the current market rate of return or capitalization rate. Annual scheduled gross income is adjusted for vacancies and credit losses to arrive at the annual effective gross income. The annual operating expenses are deducted from the annual effective gross income to arrive at the annual NOI.

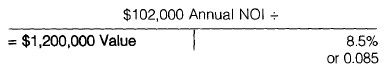

FOR EXAMPLE An office building produces $132,600 annual gross income. If the annual expenses are $30,600 and the appraiser estimates the value using an 8.5 percent rate of return, what is the estimated value?

$132,600 Annual Gross Income - $30,600 Annual Expenses = $102,000 Annual NOI

$102,000 Annual NOI

$102,000 8.5% = $1,200,000

$1,200,000 Value is the answer.

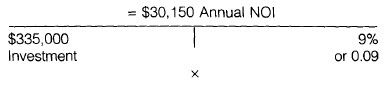

The above formulas also can be used for investment problems. The total becomes original cost or investment instead of value.

FOR EXAMPLE You invest $335,000 in a property that should produce a 9 percent rate of return. What monthly NOI will you receive?

$335,000 x 9% (.09) = $30,150

$30,150 Annual NOI ÷ 12 Months = $2,512.50

$2,512.50 Monthly NOI is the answer.

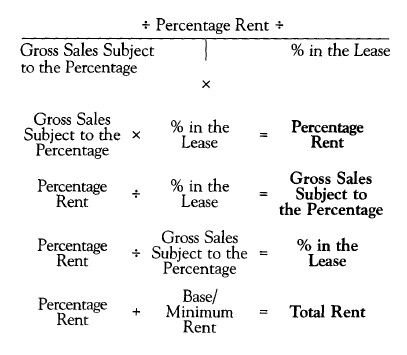

HOW DO I SOLVE PROBLEMS INVOLVING PERCENTAGE LEASES?

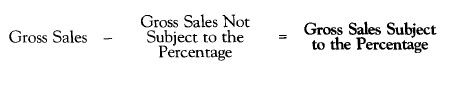

When establishing the rent to be charged in a lease for retail space, the lease may be a percentage lease instead of a lease based on dollars per square foot. In the percentage lease, there is normally a base or minimum monthly rent plus a percentage of the gross sales in excess of an amount set in the lease. The percentage lease also can be set up as a percentage of the total gross sales or of the base/minimum rent, whichever is larger. We shall look at the minimum plus percentage lease only.

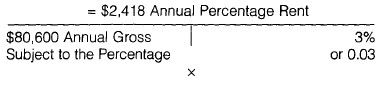

FOR EXAMPLE A lease calls for monthly minimum rent of $900 plus 3 percent of annual gross sales in excess of $270,000. What was the annual rent in a year when the annual gross sales were $350,600?

$900 Monthly Minimum Rent x 12 Months = $10,800 Annual Minimum Rent

$350,600 Annual Gross Sales - $270,000 Annual Gross Sales Not Subject to the

Percentage = $80,600 Annual Gross Sales Subject to the Percentage

$10,800 Annual Minimum Rent + $2,418 Annual Percentage Rent = $13,218

$13,218 Total Annual Rent is the answer.