CHAPTER TWENTY-THREE

REAL ESTATE INVESTMENTS

LEARNING OBJECTIVES

When you have finished reading this chapter, you should be able to

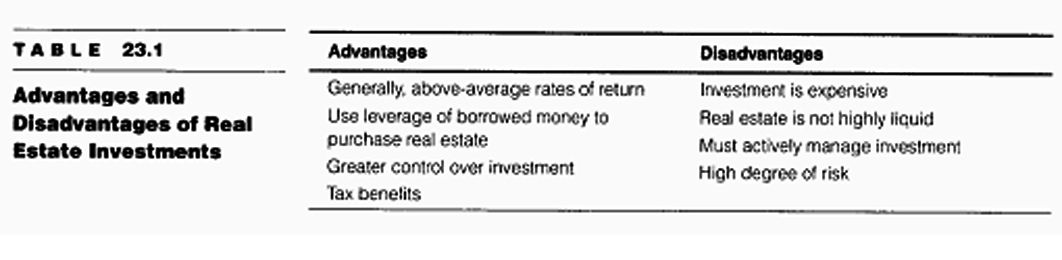

► identify the advantages and disadvantages of property investing;

► describe the difference between adjusted basis and capital gains;

► explain the concepts of pyramiding;

► distinguish between depreciation and appreciation; and

►Define the following terms: adjusted basis; appreciation; basis; boot; capital gain; cash flow; cost recovery; depreciation; equity buildup; exchanges; income property; inflation; intrinsic value; leverage; liquidity; pyramiding; real estate investment trust (REIT); real estate mortgage investment conduit (REMIC); and syndicate.

REAL ESTATE PRACTICE & PRINCIPLES KEY WORD MATCH QUIZ

--- CLICK HERE ---

I would encourage you to take this “Match quiz” now as a pre-chapter challenge to see how many of these key words or phrases you are familiar with. At the end of each chapter I recommend that you take the quiz again to reinforce these important keywords. Each page contains four words or phrases and you need to drag and drop the correct definition into the puzzle key. Each page is considered as a question, but there is no scoring and you can return to each chapter quiz as many times as needed to reinforce your memory.

WHY STUDY REAL ESTATE INVESTMENTS?

Real estate is a popular investment. Whichever way the overall market turns, the real estate investment market continues to initiate innovative and attractive investment strategies. These developments make it important for real estate licensees to have an elementary and up-to-date knowledge of real estate investment. Most homebuyers will also want assurance that a residential purchase is a good investment. A licensee should never act as an investment advisor but should instead refer investors to competent tax accountants, attorneys, or investment specialists.

Advantages of Real Estate Investment

In recent years, real estate values nationwide have significantly changed. Some investments have failed to produce returns greater than the rate of inflation, but some real estate investments have shown above-average (or even high) rates of return. In theory, this means that an investor can use borrowed money to finance a real estate purchase and feel relatively sure that an asset, if held long enough, will return more money than the cost to finance the purchase.

Real estate offers investors a greater control over their investments than other options, such as stocks, bonds, or other securities. Real estate investors also receive certain tax benefits.

Disadvantages of Real Estate Investment

Unlike stocks and bonds, real estate is not highly liquid over the short term. Liquidity refers to how quickly an asset may be converted into cash. For instance, an investor who holds stocks can easily direct a stockbroker to sell stocks when funds are needed. The stockbroker sells the stock and the investor receives the cash. In contrast, a real estate investor may have to sell the property at a substantially lower price than desired to ensure a quick sale or to refinance the property.

Real estate investments are expensive. Large amounts of capital are usually required. Investing in real estate is difficult without expert advice. Investment decisions must be based on careful studies of all the facts, reinforced by a thorough knowledge of real estate and how it is affected by the marketplace.

Real estate requires active management. A real estate investor can rarely just sit and watch the money grow. Management decisions must be made. How much rent should be charged? How should repairs and tenant grievances be handled? The investor may choose to personally manage the property or hire a professional property manager.

Finally, despite its popularity, real estate investment does not guarantee profit. It involves a high degree of risk. The possibility that an investment property will decrease in value or not generate enough income to make it profitable is a fluctuating factor for the investor to consider. The advantages and disadvantages of real estate investments are listed in Table 23.1.

THE INVESTMENT

Real estate investors anticipate various investment objectives. Their goals can be reached more effectively depending on the type of property and ownership they choose. The most prevalent form of real estate investment is direct ownership. Both individuals and corporations may own real estate directly and manage it for appreciation or cash flow (income). This type of real estate is known as income property.

Real estate is an avenue of investment open to those interested in holding property primarily for increasing value, which is known as appreciation.

Two main factors affect appreciation: inflation and intrinsic value. Inflation is the increase in the amount of money in circulation. When more money is avail-able, its value declines. When the value of money declines, wholesale and retail prices rise. This is essentially an operation of supply and demand, as discussed in Chapter 1. An intrinsic value of real estate is the result of a person's individual choices and preferences for a given geographic area. For example, property located in a pleasant neighborhood near attractive business and shopping areas has a greater intrinsic value to most people than similar property in a more isolated location. As a rule, the greater the intrinsic value, the more money a property commands on its sale.

Unimproved land

Often, investors speculate in purchases of either agricultural land or undeveloped land located in what they expect to be a major path of growth. In these cases, however, the property's intrinsic value and potential for appreciation are not easy to determine. This type of investment carries many inherent risks. How fast will the area develop? Will it grow sufficiently for the investor to make a good profit? Will the expected growth occur? More important, will the profits eventually realized from the property be great enough to offset the costs of holding it, such as property taxes? Because these questions often cannot be answered with any degree of certainty, lending institutions may be reluctant to lend money for the purchase of raw land.

Income tax laws do not allow for the depreciation of land. Land also might not be liquid (salable) at certain times under certain circumstances because few people will purchase raw or agricultural land on short notice. Despite all the risks, land has historically been a good inflation hedge if it is held for the long term.

Investment in land ultimately is best left to experts, and even they frequently make bad land investment decisions.

Income

A person who wishes to buy and personally manage real estate may find that rental income property is the best investment.

Cash flow

The objective of directing funds into income property is to generate spendable income, called cash flow. Cash flow is the total amount of money remaining after all expenditures have been paid. These expenses include taxes, operating costs, and maintenance. The cash flow produced by any given parcel of real estate is determined by at least three factors: amount of rent received, operating expenses, and method of debt repayment.

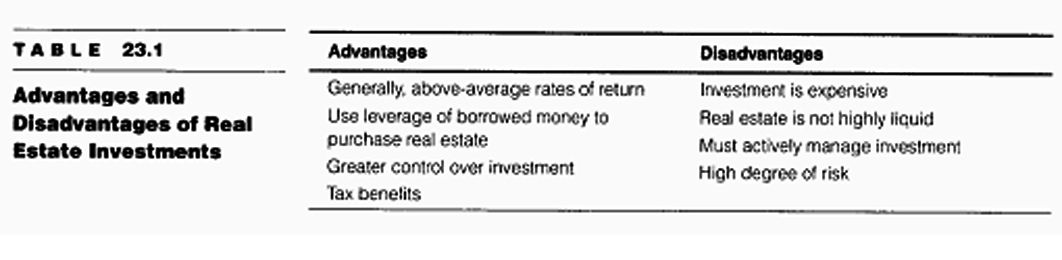

Generally, the amount of rent (income) that a property may command depends on a number of factors, including the property's location, physical appearance, and amenities. If the cash flow from rents is not enough to cover all expenses, negative cash flow may result. For example, Table 23.2 shows a negative cash flow.

To keep cash flow high, an investor should attempt to keep operating expenses reasonably low. Such operating expenses include general building maintenance, repairs, utilities, and tenant services.

An investor often stands to make more money by investing with borrowed money, usually obtained through a mortgage loan or deed of trust loan. Low mortgage payments spread over a long period result in a higher cash flow because they allow the investor to retain more income each month. In turn, high mortgage payments contribute to a lower cash flow.

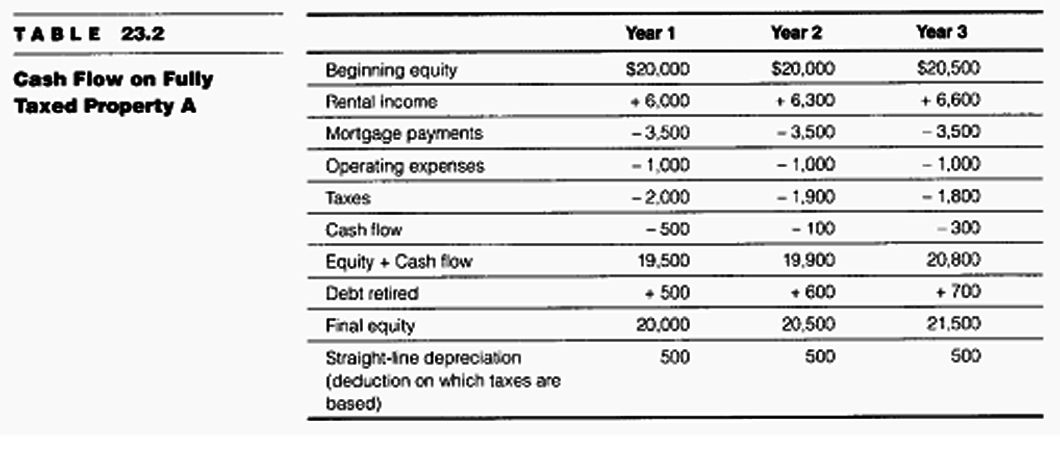

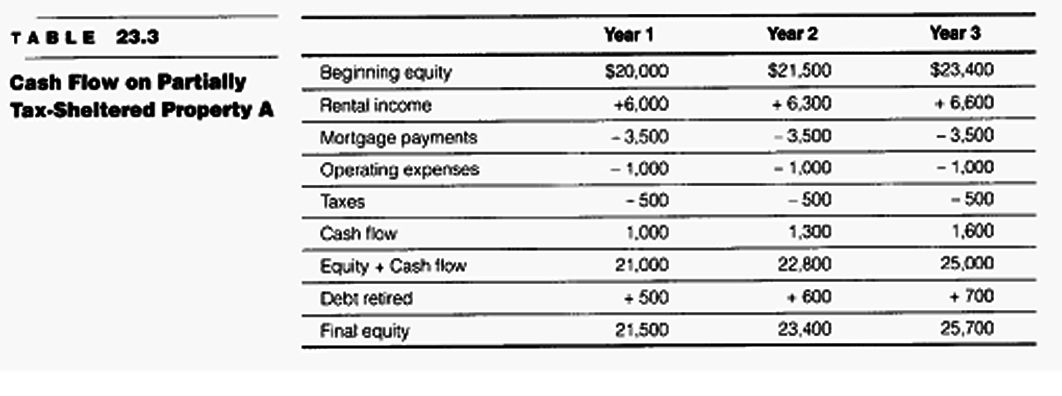

The charts in Tables 23.2 and 23.3 compare the cash flows of taxable and tax-sheltered real estate investments.

Investment opportunities Income-producing properties include apartment and office buildings, hotels, motels, shopping centers, and industrial properties, but some communities have experienced severe overbuilding of office space and shopping centers. The result has been higher-than-average vacancy rates.

LEVERAGE

Leverage is the use of borrowed money to finance an investment. As a rule, an investor can receive a maximum return from the initial investment by making a small down payment, paying a low interest rate, and spreading mortgage payments over as long a period as possible.

The effect of leveraging is to provide a return that reflects the result of market forces on the entire original purchase price but that is measured only against the actual cash invested. For example, if an investor spends $100,000 for rental property, makes a $20,000 down payment, and then sells the property five years later for $125,000, the return over five years is $25,000. Disregarding ownership expenses, the return is not 25 percent ($25,000 compared with $100,000), but 125 percent of the original amount invested ($25,000 compared with $20,000).

Risks are directly proportionate to leverage. A high degree of leverage translates into

greater risk for the investor and the lender because of the high ratio of borrowed money to the value of the real estate. Lower leverage results in less risk. When property values drop in an area or vacancy rates rise, the highly leveraged investor may be unable to pay even the financing costs of the property.

Equity Buildup

Equity buildup is a result of a loan payment directed toward the principal rather than the interest, plus any gain in property value due to appreciation. In a sense, equity buildup is like money in the investor's bank account. This accumulated equity is not realized as cash unless the property is sold, refinanced, or exchanged.

Pyramiding

An effective method for real estate investors to increase their holdings without investing additional capital is through pyramiding. Pyramiding is the process of using one property to drive the acquisition of additional properties. Two methods of pyramiding can be used: pyramiding through sale and pyramiding through refinance.

In pyramiding through sale, an investor first acquires a property and then improves it for resale at a substantially higher price. The profit from the sale of the first property is used to purchase additional properties. The disadvantage is that the proceeds from each sale are subject to capital gains taxation.

FOR EXAMPLE A woman bought a house for $340,000. She put an addition on the house and a new roof. In three years, the woman sold the home for $420,000. After deducting commission and selling expenses, she used the $80,000 profit to buy another property.

The goal of pyramiding through refinancing is to use the value of the original property to drive the acquisition of additional properties while retaining all the properties acquired. The investor refinances the original property and uses the proceeds of the refinance to purchase additional properties. These properties are refinanced, enabling the investor to acquire further properties. By holding on to the properties, the investor may delay the capital gains taxes that would result from a sale.

TAX BENEFITS

Income tax laws change frequently, and some tax advantages of owning investment real estate are altered periodically by Congress. An investor can make a more educated and profitable real estate purchase with professional tax advice.

Capital Gains

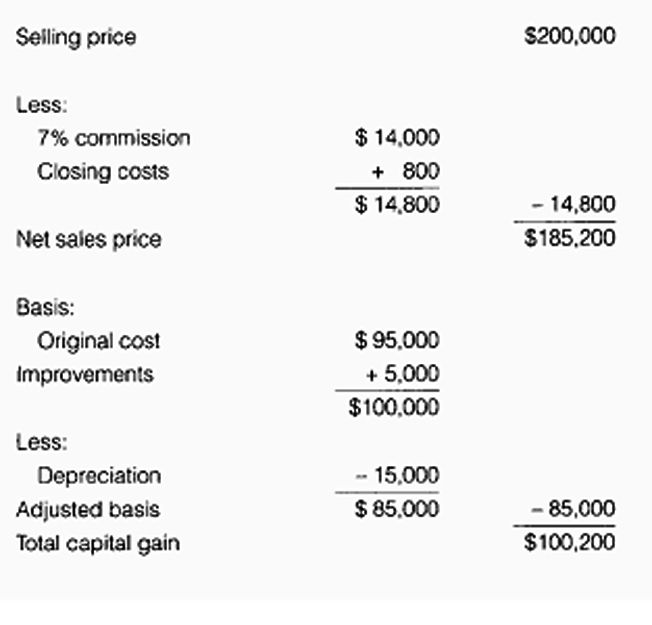

Capital gain is defined as the difference between the adjusted basis of property and its net selling price. At various times, the tax law has excluded a portion of capital gains from income tax and taxed various types of gains differently.

Basis A property's cost basis determines the amount of gain to be taxed. The basis of the property is the investor's initial cost of the real estate. The investor adds to the basis the cost of any physical improvements subsequently made to the property. The amount of any depreciation claimed as a tax deduction is subtracted from the basis. The result is the property's adjusted basis. When the investor sells the property, the amount by which the sales price exceeds the property's adjusted basis is the capital gain.

FOR EXAMPLE Some time ago, an investor purchased a single-family home for use as a rental property. The purchase price was $95,000. The investor now sells the property for $200,000. Shortly before the sale date, the investor makes $5,000 worth of capital improvements to the home. Depreciation of $15,000 on the property improvements has been taken during the term of the investor's ownership.

The investor will pay a broker's commission of 7 percent of the sales price. The investor's closing costs will be $800. The capital gain is computed as follows:

Depreciation (Cost Recovery)

Depreciation, or cost recovery, allows an investor to recover the cost of an income-producing asset through tax deductions over the asset's useful life. Though investors rarely purchase property without expecting it to appreciate over time, the tax laws maintain that all physical structures deteriorate (and lose value) over time. Cost recovery deductions may be taken only on personal property and improvements to land.

Depreciation taken periodically in equal amounts over an asset's useful life is called straight-line depreciation. For certain property purchased before 1987, it was also possible to use an accelerated cost recovery system (ACRS) to claim greater deductions in the early years of ownership, gradually reducing the amount deducted in each year of useful life. The Taxpayer Relief Act of 1997 established specific rules governing holding periods and taxability of depreciation for real property. Depreciation is set by statute. Currently, statutory depreciation is 27.5 years for residential real estate and 39 years for commercial real estate.

Exchanges

Real estate investors can defer taxation of capital gains by making property exchanges. Even property that has appreciated greatly since its initial purchase may be exchanged for other property. A property owner will incur tax liability on a sale only if additional capital or property is also received: the tax is deferred, not eliminated. Whenever the investor sells the property, the capital gain will be taxed. In many states, state income taxes can also be deferred by using the exchange form of property transfer.

To qualify as a tax-deferred exchange, the properties involved must be of like kind as defined under Section 1031 of the Internal Revenue Code. The exchanged property must be real estate of equal value and same use. Any additional capital or personal property included with the transaction to even out the value of the exchange is called boot. The IRS requires tax on the boot to be paid at the time of the exchange by the party who receives it. The value of the boot is added to the basis of the property for which it is given. Tax-deferred exchanges are governed by strict federal requirements, and competent guidance from a tax professional is essential.

FOR EXAMPLE A person owns an apartment building with an adjusted basis of $225,000 and a market value of $375,000. That person exchanges the building plus $75,000 in cash for another apartment building having a market value of $450,000. That building has an adjusted basis of $175,000. The owner's basis in the new building is $300,000 (the $225,000 basis of the building exchanged plus the $75,000 cash boot paid), and there is no tax liability on the exchange. The previous owner of the new building must pay tax on the $75,000 boot received and has a basis of $175,000 (the same as the previous building) in the building now owned.

Deductions

In addition to tax deductions for depreciation, investors may be able to deduct losses from their real estate investments. The tax laws are very complex. The amount of loss that may be deducted depends on whether an investor actively participates in the day-to-day management of the rental property or makes management decisions. Other factors are the amount of the loss and the source of the income from which the loss is to be deducted. Investors who do not actively participate in the management or operation of the real estate are considered passive investors. Passive investors may not use losses to offset active income derived from active participation in real estate management, wages, or income from stocks, bonds, and the like. The tax code cites specific rules for active and passive income and losses and may be subject to changes.

Certain tax credits are allowed for the renovation of older buildings, low-income housing projects, and historic property. A tax credit is a direct reduction in the tax due rather than a deduction from income before tax is computed. Tax credits encourage the revitalization of older properties and the creation of low-income housing.

Installment Sales

A taxpayer who sells real property and receives payment on an installment basis pays tax only on the profit portion of each payment received. Interest received is taxable as ordinary income.

REAL ESTATE INVESTMENT SYNDICATES

A real estate investment syndicate is a business venture in which people pool their resources to own or develop a particular piece of property. This structure permits people with only modest capital to invest in large-scale operations. Typical syndicate projects include highrise apartment buildings and shopping centers. Syndicate members realize some profit from rents collected on the investment. The main return usually comes when the syndicate sells the property.

Syndicate participation can take many legal forms. For instance, syndicate members may hold property as tenants in common or as joint tenants. Various kinds of partnership, corporate, and trust ownership options are possible.

Private syndication generally involves a small group of closely associated or experienced investors. Public syndication involves a much larger group of investors who may or may not be knowledgeable about real estate as an investment. Any pooling of individuals' funds raises questions of securities registration under federal and state securities laws, known as blue-sky laws.

REAL ESTATE INVESTMENT TRUSTS

By directing their funds into a real estate investment trust (REIT), real estate investors take advantage of the same tax benefits as do mutual fund investors. A real estate investment trust does not have to pay corporate income tax as long as 95 percent of its income is distributed to its shareholders. Certain other conditions also must be met. To qualify as a REIT, at least 75 percent of the trust's income must come from real estate. Investors purchase certificates in the trust, which in turn invests in real estate or mortgages (or both). Profits are distributed to investors.

REAL ESTATE MORTGAGE INVESTMENT CONDUITS

A real estate mortgage investment conduit (REMIC) has complex qualification, transfer, and liquidation rules. For instance, the REMIC must satisfy the asset test. The asset test requires that after a start-up period, almost all assets must be qualified mortgages and permitted investments. Furthermore, investors' interests may consist of only one or more classes of regular interests and a single class of residual interests. Holders of regular interests receive interest or similar payments based on either a fixed rate or a variable rate. Holders of residual interests receive distributions (if any) on a pro rata basis.

SUMMARY

Traditionally, real estate investment has offered an above-average rate of return while acting as an effective hedge against inflation. It allows an investor to use other people's money through leverage. There may also be tax advantages to owning real estate. However, real estate is not a highly liquid investment and often carries a high degree of risk. Expert advice is often necessary.

Investment property held for appreciation purposes is generally expected to increase in value to a point at which its selling price covers holding costs and permits a profit. The two main factors that affect appreciation are inflation and the property's present and future intrinsic value. Real estate held for income purposes is generally expected to generate a steady flow of income, called cash flow, and to show a profit at the time of sale.

An investor who hopes to use maximum leverage in financing an investment should make a small down payment, pay low interest rates, and spread mortgage payments over as long a period as possible. By holding and refinancing proper-ties, a practice known as pyramiding, an investor may substantially increase investment holdings without contributing additional capital. The highly lever-aged investor has correspondingly high risk.

By exchanging one property for another with an equal or a greater selling value, an investor can defer paying tax on the gain realized until a sale is made. A total tax deferment is possible only if the investor receives no cash or other incentive to even out the exchange. If such cash or property is received, it is called boot, and it is taxed. In addition, there must also be no debt relief to defer paying taxes.

Depreciation (cost recovery) is a concept that allows an investor to recover in tax deductions the basis of an asset over its useful life. Only costs of improvements to land may be recovered, not costs for the land itself. The Tax Reform Act of 1986 greatly limited the potential for investment losses to shelter other income. But tax credits are still allowed for projects involving low-income housing and older buildings.

An investor may defer federal income taxes on a gain realized from the sale of an investment property through an installment sale of property.

Individuals may also invest in real estate through an investment syndicate. These usually consist of general and limited partnerships. Other forms of real estate investment include real estate investment trusts (REITs) and real estate mortgage investment conduits (REMICs).

Real estate brokers and salespersons should be familiar with the rudimentary tax implications of real property ownership but should refer clients to competent tax advisers for answers to specific questions.