CHAPTER FIFTEEN

REAL ESTATE FINANCING: PRACTICE

LEARNING OBJECTIVES

When you've finished reading this Chapter, you should be able to:

► identify the types of institutions in the primary and secondary mortgage markets.

► describe the various types of financing techniques available to real estate purchasers and the role of government financing regulations.

► explain the requirements and qualifications for conventional, FHA, and VA loan programs.

► distinguish among the different types of "creative" financing techniques that address borrowers' different needs.

► define the following terms: adjustable-rate mortgage (ARM); amortized loan; balloon payment; blanket loan;

buydown; certificate of reasonable value (CRV); Community Reinvestment Act of 1977 (CRA); computerized loanorigination (CLO); construction loan; conventional loan; Equal Credit Opportunity Act (ECOA); Fannie Mae; Federal Deposit Insurance Corporation (FDIC); Federal Reserve System (Fed); FHA loan; Freddie Mac; Ginnie Mae; growing-equity mortgage; home equity loan; index; interest-only mortgage; loan-to-value (LTV) ratio margin; mortgage insurance premium (MIP); open-end loan; package loan; primary mortgage market; private mortgage insurance (PMI); purchase-money mortgage (PMM); Real Estate Settlement Procedures Act (RESPA); Regulation Z; reverse mortgage; sale-and-leaseback; secondary mortgage market; straight loan; trigger terms; Truth in Lending Act; VA loan; and wraparound loan.

REAL ESTATE PRACTICE & PRINCIPLES KEY WORD MATCH QUIZ

--- CLICK HERE ---

I would encourage you to take this “Match quiz” now as a pre-chapter challenge to see how many of these key words or phrases you are familiar with. At the end of each chapter I recommend that you take the quiz again to reinforce these important keywords. Each page contains four words or phrases and you need to drag and drop the correct definition into the puzzle key. Each page is considered as a question, but there is no scoring and you can return to each chapter quiz as many times as needed to reinforce your memory.

WHY LEARN ABOUT REAL ESTATE FINANCING PRACTICE?

Like the previous Chapter, this one goes directly to the heart of your client's real estate transaction. Having an understanding of current financing techniques and sources of financing can help you direct buyers to the mortgage loans that will help the buyers reach their real estate goals. Most real estate transactions require some sort of financing. Few people have the cash in hand necessary to buy a house or another large property. Also, as economic conditions change, the forces of supply and demand reshape the real estate market. These factors have combined to create a complex and rapidly evolving mortgage market. One of the greatest challenges today's real estate licensees face is how to maintain a working knowledge of all the financing techniques available. If you understand financing techniques, the actors involved in the mortgage market, and the mortgage options available to your clients, you will be able to provide a valuable, attractive service to the public.

INTRODUCTION TO THE REAL ESTATE FINANCING MARKET

The real estate financing market has the following three basic components:

1) Government influences, primarily the Federal Reserve System, but also the Home Loan Bank System and the Office of Thrift Supervision

2) The primary mortgage market

3) The secondary mortgage market

Under the umbrella of the financial policies set by the Federal Reserve System, the primary mortgage market originates loans that are bought, sold, and traded in the secondary mortgage market. Before turning to the specific types of mortgage options available to consumers, it is important to have a clear understanding of the bigger picture: the market in which those mortgages exist.

The Federal Reserve System

The role of the Federal Reserve System (also known as the Fed) is to maintain sound credit conditions, help counteract inflationary and deflationary trends, and create a favorable economic climate. The Federal Reserve System divides the country into 12 federal reserve districts, each served by a federal reserve bank. All nationally chartered banks must join the Fed and purchase stock in its district reserve banks.

The Federal Reserve System regulates the flow of money and interest rates in the marketplace through its member banks by controlling their reserve requirements and discount rates. The Fed also can regulate the money supply through the Federal Open Market Committee (FOMC), which buys and sells U.S. government securities on the open market. When the FOMC sells securities, it effectively removes the money paid by buyers from circulation. When it buys them, it infuses its own reserves back into the general supply.

Reserve requirements. The Federal Reserve System requires that each member bank keep a certain amount of assets on hand as reserve funds. These reserves are unavailable for loans or any other use. This requirement not only protects customer deposits, but it also provides a means of manipulating the flow of cash in the money market.

By increasing its reserve requirements, the Federal Reserve in effect limits the amount of money that member banks can use to make loans. When the amount of money available for lending decreases, interest rates (the amount lenders charge for the use of their money) rise. By causing interest rates to rise, the government can slow down an overactive economy by limiting the number of loans that would have been directed toward major purchases of goods and services. The opposite is also true: By decreasing the reserve requirements, the Fed can encourage more lending. Increased lending causes the amount of money circulated in the marketplace to rise, while simultaneously causing interest rates to drop.

Discount rates. Federal Reserve member banks are permitted to borrow money from the district reserve banks to expand their lending operations. The discount rate is the rate charged by the Federal Reserve when it lends to its member banks. The Federal Funds rate is the rate recommended by the Federal Reserve for the member banks to charge each other on short-term loans. These rates form the basis on which the banks determine the percentage rate of interest they will charge their loan customers. The prime rate, the short-term interest rate charged to a bank's largest, most creditworthy customers, is strongly influenced by the Fed's discount rate. In turn, the prime rate is often the basis for determining a bank's interest rate on other loans, including mortgages. These rates are usually higher than the prime rate. In theory, when the Federal Reserve discount rate is high, bank interest rates are high. When bank interest rates are high, fewer loans are made and less money circulates in the marketplace. On the other hand, a lower discount rate results in lower overall interest rates, more bank loans, and more money in circulation.

The Primary Mortgage Market

The primary mortgage market is made up of the lenders that originate mortgage loans. These lenders make money available directly to borrowers. From a borrower's point of view, a loan is a means of financing an expenditure; from a lender's point of view, a loan is an investment. All investors look for profitable returns on their investments. For a lender, a loan must generate enough income to be attractive as an investment. Income on the loan is realized from the following two sources:

1) Finance charges collected at closing, such as loan origination fees and discount points

2) Recurring income, that is, the interest collected during the term of the loan

An increasing number of lenders look at the income generated from the fees charged in originating loans as their primary investment objective. Once the loans are made, they are sold to investors. By selling loans to investors in the secondary mortgage market, lenders generate funds with which to originate additional loans.

In addition to the income directly related to loans, some lenders derive income from servicing loans for other mortgage lenders or investors who have purchased the loans. Servicing involves such activities as

► collecting payments (including insurance and taxes),

► accounting,

► bookkeeping,

► preparing insurance and tax records,

► processing payments of taxes and insurance, and

► following up on loan payment and delinquency.

The terms of the servicing agreement stipulate the responsibilities and fees for the service.

Some of the major lenders in the primary market include the following:

► Thrifts, savings associations, and commercial banks. These institutions are known as fiduciary lenders because of their fiduciary obligations to protect and preserve their despositors' funds. "Thrifts" is a generic term for the savings associations. Mortgage loans are perceived as secure investments for generating income and enable these institutions to pay interest to their depositors. Fiduciary lenders are subject to standards and regulations established by government agencies such as the Federal Deposit Insurance Corporation (FDIC) and the Office of Thrift Supervision (OTS). These agencies govern the practices of fiduciary lenders. The various government regulations (which include reserve fund, reporting, and insurance requirements) are intended to protect depositors against the reckless lending that characterized the savings and loan industry in the 1980s.

► Insurance companies. Insurance companies accumulate large sums of money from the premiums paid by their policyholders. While part of this money is held in reserve to satisfy claims and cover operating expenses, much of it is free to be invested in profit-earning enterprises, such as long-term real estate loans. Although insurance companies are considered primary lenders, they tend to invest their money in large, long-term loans that finance commercial, industrial, and larger multifamily properties rather than single-family home mortgages.

► Credit unions. Credit unions are cooperative organizations whose members place money in savings accounts. In the past, credit unions made only short-term consumer and home improvement loans. Recently, however, they have branched out to originating longer-term first and second mortgage and deed of trust loans.

► Pension funds. Pension funds usually have large amounts of money available for investment. Because of the comparatively high yields and low risks offered by mortgages, pension funds have begun to participate actively in financing real estate projects. Most real estate activity for pension funds is handled through mortgage bankers and mortgage brokers.

► Endowment funds. Many commercial banks and mortgage bankers handle investments for endowment funds. The endowments of hospitals, universities, colleges, charitable foundations, and other institutions provide a good source of financing for low-risk commercial and industrial properties.

► Investment group financing. Large real estate projects, such as highrise apartment buildings, office complexes, and shopping centers, are often financed as joint ventures through group financing arrangements like syndicates, limited partnerships, and real estate investment trusts. These complex investment agreements are discussed in Appendix 1.

► Mortgage banking companies. Mortgage banking companies originate mortgage loans with money belonging to insurance companies, pension funds, and individuals, and with funds of their own. They make real estate loans with the intention of selling them to investors and receiving a fee for servicing the loans. Mortgage banking companies are generally organized as stock companies. As a source of real estate financing, they are subject to fewer lending restrictions than are commercial banks or savings associations. Mortgage banking companies often are involved in all types of real estate loan activities and often serve as intermediaries between investors and borrowers. They are not mortgage brokers.

► Mortgage brokers. Mortgage brokers are not lenders. They are intermediaries who bring borrowers and lenders together. Mortgage brokers locate potential borrowers, process preliminary loan applications, and submit the applications to lenders for final approval. Frequently, they work with or for mortgage banking companies. They do not service loans once the loans are made. Mortgage brokers also may be real estate brokers who offer these financing services in addition to their regular real estate brokerage activities. Many state governments are establishing separate licensure requirements for mortgage brokers to regulate their activities.

IN PRACTICE An exciting new trend for consumers is the prospect of applying for mortgage loans from their home computers via the Internet in the same way they can buy books or order airline tickets. Many major lenders have Web sites that offer substantial information to potential borrowers regarding their current programs and regulations. In addition, online brokerage or matchmaking organizations have emerged that link lenders with potential borrowers. Some borrowers prefer the speed of the Internet process as well as having access to a wide variety of loan programs. However, the loan approval process may not necessarily be faster than traditional application processing. Still, online "matchmakers," lenders, and brokers offer convenience and the ability to easily shop for the best rates and terms.

Information on the Internet regarding lenders and their programs is constantly changing. Consider using a search engine such as www.altavista.com, www.excite.com, www.google.com, www.lycos.com, or www.yahoo.com, to search for terms such as real estate, financing, lending programs, and/or home mortgages.

The Secondary Mortgage Market

In addition to the primary mortgage market, where loans are originated, there is a secondary mortgage market. Here, loans are bought and sold only after they have been funded. Lenders routinely sell loans to avoid interest rate risks and to realize profits on the sales. This secondary market activity helps lenders raise capital to continue making mortgage loans. Secondary market activity is especially desirable when money is in short supply; it stimulates both the housing construction market and the mortgage market by expanding the types of loans available. Growth in the use of secondary markets has greatly increased the standardization of loans.

When a loan is sold, the original lender may continue to collect the payments from the borrower. The lender then passes the payments along to the investor who purchased the loan. The investor is charged a fee for servicing of the loan.

In the secondary mortgage market, various agencies purchase a number of mortgage loans and assemble them into packages (called pools). These agencies purchase the mortgages from banks and savings associations. Securities that represent shares in these pooled mortgages are then sold to investors or other agencies. Loans are eligible for sale to the secondary market only when the collateral, borrower, and documentation meet certain requirements to provide a degree of safety for the investors. The major warehousing agencies are discussed in the following paragraphs.

Fannie Mae. Fannie Mae (formerly the Federal National Mortgage Association or FNMA) is a quasi-governmental agency. It is organized as a privately owned corporation that issues its own common stock and provides a secondary market for mortgage loans. Fannie Mae deals in conventional and FHA and VA loans. Fannie Mae buys a block or pool of mortgages from a lender in exchange for mortgage-backed securities, which the lender may keep or sell. For more information visit www.fanniemae.com

Ginnie Mae. Unlike Fannie Mae, Ginnie Mae (formerly the Government National Mortgage Association, or GNMA) is entirely a governmental agency. Ginnie Mae is a division of the Department of Housing and Urban Development (HUD), organized as a corporation without capital stock. Ginnie Mae administers special-assistance programs and works with Fannie Mae in secondary market activities.

In times of tight money and high interest rates, Fannie Mae and Ginnie Mae can join forces through their tandem plan. The tandem plan provides that Fannie Mae can purchase high-risk, low-yield (usually FHA) loans at full market rates, with Ginnie Mae guaranteeing payment and absorbing the difference between the low yield and current market prices.

Ginnie Mae also guarantees investment securities issued by private offerors (such as banks, mortgage companies, and savings and loan associations) and backed by pools of FHA and VA mortgage loans. The Ginnie Mae pass-through certificate is a security interest in a pool of mortgages that provides for a monthly pass-through of principal and interest payments directly to the certificate holder. Such certificates are quaranteed by Ginnie Mae. For more information visit www.ginniemae.gov

Freddie Mac. Freddie Mac (formerly the Federal Home Loan Mortgage Corporation, or FHLMC) provides a secondary market for mortgage loans, primarily conventional loans. Freddie Mac has the authority to purchase mortgages, pool them and sell bonds in the open market with the mortgages as security. However, Freddie Mac does not guarantee payment of Freddie Mac mortgages.

Many lenders use the standardized forms and follow the guidelines issued by Fannie Mae and Freddie Mac. In fact, the use of such forms is mandatory for lenders that wish to sell mortgages in the agencies' secondary mortgage market. The standardized documents include loan applications, credit reports, and appraisal forms. . For more information visit www.freddiemac.com

Because Fannie Mae's and Freddie Mac's involvement in the secondary market is so pervasive, many underwriting guidelines are written to comply with their regulations. Bank statements, tax returns, verifications of employment and child support—most of the paperwork a potential borrower must deal with—may be tied to Fannie Mae and Freddie Mac requirements.

FINANCING TECHNIQUES

Now that you understand where real estate financing comes from, we'll turn to the what: the types of financing available. Real estate financing comes in a wide variety of forms. While the payment plans described in the following sections are commonly referred to as mortgages, they are really loans secured by either a mortgage or a deed of trust.

Straight Loans

A straight loan (also known as a term loan) essentially divides the loan into two amounts, to be paid off separately. The borrower makes periodic payments of interest only, followed by the payment of the principal in full at the end of the term. Straight loans were once the only form of mortgage available. Today, they are generally used for home improvements and second mortgages rather than for residential first mortgage loans.

Balloon Payment Loan

When the periodic payments are not enough to fully amortize the loan by the time the final payment is due, the final payment is larger than the others. This is called a balloon payment. It is a partially amortized loan because principal is still owed at the end of the term. It is frequently assumed that if payments are made promptly, the lender will extend the balloon payment for another limited term. The lender, however, is not legally obligated to grant this extension and can require payment in full when the note is due.

MATH CONCEPTS BALLOON PAYMENT LOAN

Consider a loan with the following terms: $80,000 at 8 percent interest, with only interest payable monthly and the loan fully repayable in 15 years. This is how to calculate the amount of the final balloon payment:

$80,000 x .08 = $6,400 annual interest

$6,400 annual interest ÷ 12 months = $533.33 monthly interest payment $80,000 principal payment + $533.33 final month's interest

The down side is a $80,533.33 final balloon payment

Amortized Loans

The word amortize literally means "to kill off slowly, over time." Most mortgage and deed of trust loans are amortized loans. That is, they are paid off slowly, over time, in equal payments. Regular periodic payments are made over a term of years. The most common periods are 15 years or 30 years, although 20-year mortgages are also available. Unlike a straight loan payment, the payment in an amortized loan partially pays off both principal and interest. Each payment is applied first to the interest owed; the balance of the payment is then applied to the principal amount.

At the end of the term, the full amount of the principal and all interest due is reduced to zero. Such loans are also called direct reduction loans. Most amortized mortgage and deed of trust loans are paid in monthly installments. However, some are payable quarterly (four times a year) or semiannually (twice a year).

Different payment plans tend alternately to gain and lose favor with lenders and borrowers as the cost and availability of mortgage money fluctuate. The most frequently used plan is the fully amortized loan, or level-payment loan. The mortgagor pays a constant amount, usually monthly. The lender credits each payment first to the interest due, then to the principal amount of the loan. As a result, while each payment remains the same, the portion applied to repayment of the principal grows and the interest due declines as the unpaid balance of the loan is reduced. If the borrower pays additional amounts that are applied directly to the principal, the loan will amortize more quickly. This benefits the borrower because he or she will pay less interest if the loan is paid off before the end of its term. Of course, lenders are aware of this, too, and may guard against unprofitable loans by including penalties for early payment.

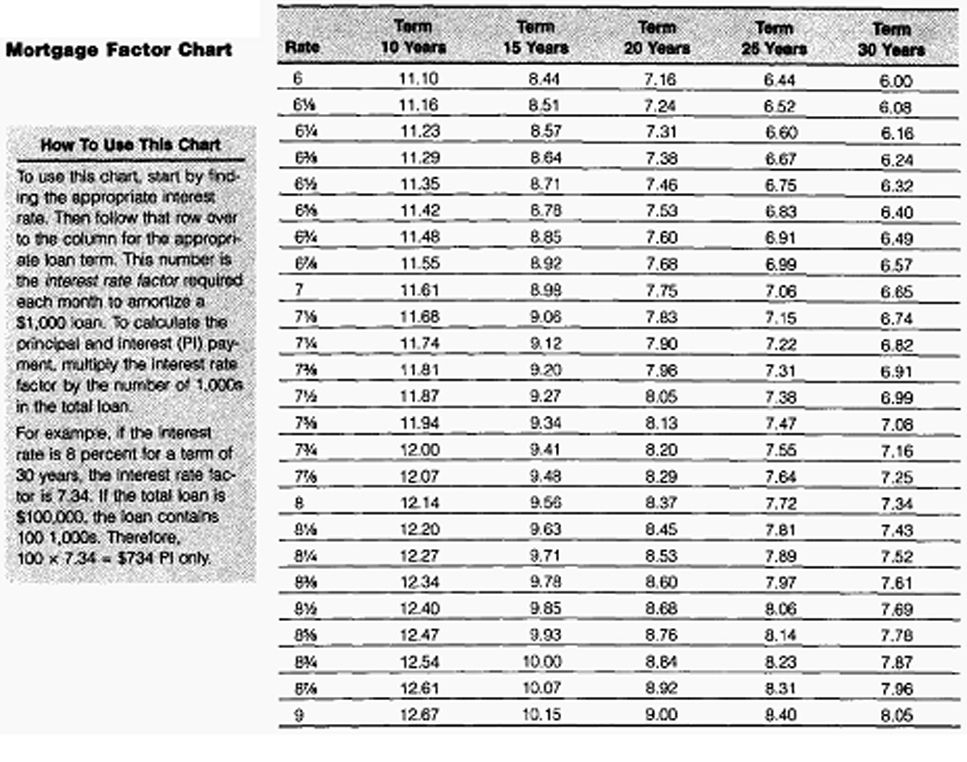

The amount of the constant payment of an amortizing loan is determined from a prepared mortgage payment book or a mortgage factor chart like the one on page 15-6. The mortgage factor chart indicates the amount of monthly payment per $1,000 of loan, depending on the term and interest rate. This factor is multiplied by the number of thousands (and fractions of thousands) of the amount borrowed.

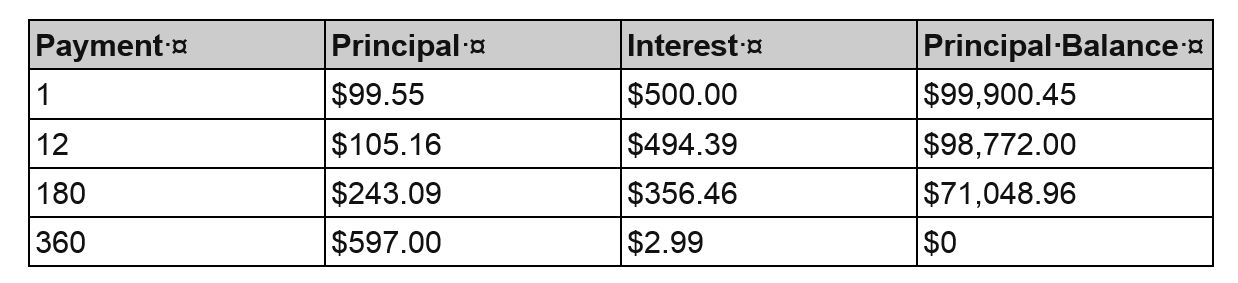

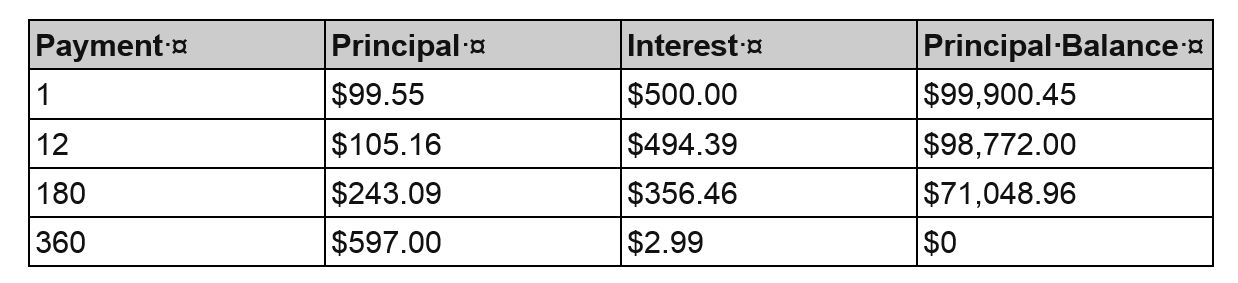

In our example of a $100,000, 30-year mortgage, the amortization schedule consists of 360 payments. The partial amortization schedule shown below demonstrates how the balance between principal and interest payments reverses over time as later payments consist primarily of principal.

As the chart shows, each of the required payments is $599.55, but the amount dedicated toward principal and interest varies from payment to payment. Because of the inverse relationship between principal and interest paid, at the start of your mortgage the rate at which you gain equity in your home is much slower. This demonstrates the value of making extra principal payments if the mortgage permits pre-payment. Each extra payment results in a larger repaid portion of the principal, and reduces the interest due on each future payment, moving the homeowner toward the ultimate goal: paying off the mortgage.

IN PRACTICE Of course, there are relatively inexpensive calculators that will accurately perform most of the standard mortgage lending calculations. The Career Institute prefers the simple to use real estate finance calculator by Calculated Industries is the Real Estate Master IIIx which will give you answers to all your financing problems at your fingertips. Carry it with you on appointments with clients and impress them with your financial expertise and instant answers.

the Real Estate Master IIIx will calculate complete P&I, PITI and FHA payment solutions, amortization, Rent vs. Buy comparisons and much more. The Career Institute also offers advanced continuing education using Calculated Industries in an TREC approved course "Practical Real Estate Calculations" which offers 6 hours of continuing education for new real estate agents. One caveat is, Calculated Industries calculators are not allowed into the room when you take your Tennessee Real Estate exam --- so there is no point learning to use it to take the test.

It is also good to remember that mortgage lenders with a Web presence provide mortgage calculators on their Web sites. Nonetheless, it's valuable both to know what the calculator is doing and to be able to perform the calculations manually if the calculator breaks. You may also find a mortgage calculator on Zillow’s Web site helpful. Find it here: http://www.zillow.com/mortgage-calculator/amortization-schedule-calculator/

Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage (ARM) is generally originated at one rate of interest. That rate then fluctuates up or down during the loan term, based on some objective economic indicator. Because the interest rate may change, the mortgagor's loan repayments also may change. Details of how and when the interest rate will change are included in the note. Common components of an ARM include the following:

► The interest rate is tied to the movement of an objective economic indicator called an index. Most indexes are tied to U.S. Treasury securities.

► Usually, the interest rate is the index rate plus a premium, called the margin. The margin represents the lender's cost of doing business. For example, the loan rate may be 2 percent over the U.S. Treasury bill rate.

► Rate caps limit the amount the interest rate may change. Most ARMs have two types of rate caps—periodic and life-of-the-loan (or aggregate). A periodic rate cap limits the amount the rate may increase at any one time. An aggregate rate cap limits the amount the rate may increase over the entire life of the loan.

► The mortgagor is protected from unaffordable individual payments by the payment cap. The payment cap sets a maximum amount for payments. With a payment cap, a rate increase could result in negative amortization—that is, an increase in the loan balance. ► The adjustment period establishes how often the rate may be changed. For instance, the adjustment period may be monthly, quarterly, or annually.

► Lenders may offer a conversion option, which permits the mortgagor to convert from an adjustable-rate to a fixed-rate loan at certain intervals during the life of the mortgage. The option is subject to certain terms and conditions for the conversion.

Obviously, without rate caps and payment caps, a single mortgage's interest rate could fluctuate wildly over several adjustment periods, depending on the behavior of the index to which it is tied. For a better understanding of ARMs visit: http://www.bankrate.com/finance/mortgages/understanding-adjustable-rate-mortgages.aspx

Growing-Equity Mortgage (GEM)

A growing-equity mortgage (GEM) is also known as a rapid-payoff mortgage. The GEM uses a fixed interest rate, but payments of principal are increased according to an index or a schedule. Thus, the total payment increases, and the loan is paid off more quickly. A GEM is most frequently used when the borrower's income is expected to keep pace with the increasing loan payments.

Reverse-Annuity Mortgage (RAM)

A reverse-annuity mortgage (RAM) is one in which payments are made by the lender to the borrower. The payments, which may be made as regular monthly payments, in one lump sum, or as a line of credit to be drawn against, are based on the equity the homeowner has invested in the property given as security for the loan. This loan allows senior citizens on fixed incomes to realize, or use, the equity they have built up in their homes without having to sell. The borrower is charged a fixed rate of interest, and the loan is eventually repaid from the sale of the property or from the borrower's estate on his or her death.

Because a RAM does not require selling the home through open marketing, RAMs have little to do with traditional home sales. More information can be found here: here www.reversemortgage.org

LOAN PROGRAMS

Mortgage loans are generally classified based on their loan-to-value ratios, or LTVs. The LTV is the ratio of debt to value of the property. Value is the sale price or the appraisal value, whichever is less. The lower the ratio of debt to value, the higher the down payment by the borrower. For the lender, the higher down payment means a more secure loan, which minimizes the lender's risk.

Conventional Loans

Conventional loans are viewed as the most secure loans because their loan-to-value ratios are often lowest. Traditionally, the ratio is 80 percent of the value of the property or less, because the borrower makes a down payment of at least 20 percent (although conventional loans with LTVs up to nearly 100 percent of the value of the property may be available). The security for the loan is provided solely by the mortgage; the payment of the debt rests on the ability of the borrower to pay. In making such a loan, the lender relies primarily on its appraisal of the security (the real estate). Information from credit reports that indicate the reliability of the prospective borrower is also important. Usually with a 20 per-cent down payment and a conventional loan, no additional insurance or guarantee on the loan is necessary to protect the lender's interest. A conventional loan is not government-insured or guaranteed, in contrast to the FHA-insured and VA-guaranteed loans described below.

Lenders can set criteria by which a borrower and the collateral are evaluated to qualify for a loan. However, in recent years the secondary mortgage market has had a significant impact on the borrower qualifications, standards for the collateral, and documentation procedures followed by lenders. Loans must meet strict criteria to be sold to Fannie Mae and Freddie Mac. Lenders still can be flexible in their lending decisions, but they may not be able to sell unusual loans in the secondary market.

To qualify for a conventional loan under Fannie Mae guidelines, for instance, the borrower's monthly housing expenses, including PITI, must not exceed 28 percent of total monthly gross income. Also, the borrower's total monthly obligations, including housing costs plus other regular monthly payments, must not exceed 36 percent of his or her total monthly gross income (33 percent in the case of 95 percent LTV loans). Loans that meet these criteria are called conforming loans, and are eligible to be sold in the secondary market. Loans that exceed the limits are referred to as nonconforming loans and are not marketable, but they must be held in the lender's investment portfolio.

Conforming loans with larger ratios may be available in certain situations. Both Fannie Mae and Freddie Mac currently have a variety of conforming affordable loan products with qualifying ratios of 33 percent for housing expense and up to 38 percent for total debt. These loans only require a 3 percent down payment but are subject to certain income limitations and may require the borrowers to attend home ownership classes.

FOR EXAMPLE Following is the qualifying math for a $100,000 loan at 7.5 percent interest for 30 years with payments of $699 per month in principal and interest:

Combined Monthly Gross Income $5,000.00

Monthly Housing Expenses:

Principal and Interest 699.00

Property Taxes 300.00

Hazard Insurance 30.00

PMI Insurance 62.50

Homeowner Association Dues 20.00

Total Housing Expense $1,111.50

$1,111.50 ÷ 5,000 = 22%

Debt Expense:

Installment Payments $100.00

Revolving Charges 50.00

Auto Loan 175.00

Child Care 200.00

Other 100.00

Total Debt Expense $625.00

Plus Housing $1,111.50

Grand Total $1,736.50 $1,736.50 ÷ 5,000 = 35%

These borrowers will qualify for this loan under conventional loan guidelines of 28 percent and 36 percent.

Private Mortgage Insurance (PMI)

One way a borrower can obtain a mortgage loan with a lower down payment is by obtaining private mortgage insurance (PMI). In a PMI program, the buyer purchases an insurance policy that provides the lender with funds in the event that the lendee defaults on the loan. This allows the lender to assume more risk so that the loan-to-value ratio is higher than for other conventional loans. The borrower purchases insurance from a private mortgage insurance company as additional security to insure the lender against borrower default. Currently, LTVs of up to 97 percent of the appraised value of the property are possible with mortgage insurance, although these percentages may change.

PMI protects the top portion of a loan, usually 25 to 30 percent, against borrower default. The borrower pays a monthly premium or fee while the insurance is in force. Other methods of payment are available, however: The premium may be financed. When a borrower has limited funds available for an initial investment, these alternative methods of reducing closing costs are very important. Because only a portion of the loan is insured, once the loan is repaid to a certain level, the lender may agree to allow the borrower to terminate the PMI coverage. Practices for termination vary from lender to lender.

IN PRACTICE Effective on new loans originating after July, 1999, a federal law requires that PMI automatically terminates if a borrower

► has accumulated at least 22 percent equity in the home and

► is current on mortgage payments.

The 22 percent of equity is based on the purchase price of the home and no credit is given for appreciation of the property. However, there may be some easing of this requirement.

Under the law, a borrower with a good payment history may request that PMI be canceled when he or she has built up equity equal to 22 percent of the purchase price. Lenders are required by the law to inform borrowers of their right to cancel PMI. Before this law was enacted, lenders could (and often did) continue to require monthly PMI payments long after borrowers had built up substantial equity in their homes and the lender no longer risked a loss from the borrower's default. Fannie Mae and Freddie Mac have extended this option to all loans that are in good standing and that have no additional financing added to the original loan.

FHA-Insured Loans

The Federal Housing Administration (FHA), which operates under HUD, neither builds homes nor lends money itself. The common term FHA loan refers to a loan that is insured by the agency. These loans must be made by FHA-approved lending institutions. The FHA insurance provides security to the lender in addition to the real estate. As with private mortgage insurance, the FHA insures lenders against loss from borrower default.

The most popular FHA program is Title II, Section 203(b), fixed-interest rate loans for 10 years to 30 years on one-family to four-family residences. Rates are competitive with other types of loans, even though they are high-LTV loans. Certain technical requirements must be met before the FHA will insure the loans. These requirements include the following:

► The borrower is charged a percentage of the loan as a premium for the FHA insurance. The up-front premium is paid at closing by the borrower or some other party. It also may be financed along with the total loan amount. The up-front premium is charged on all loans except those for the purchase of a condominium. All FHA loans will have the monthly premium charged. Insurance premiums vary for new loans, refinancing, and condominiums.

► FHA regulations set standards for type and construction of buildings, quality of neighborhood, and credit requirements for borrowers.

► The mortgaged real estate must be appraised by an approved FHA appraiser. The loan amount generally cannot exceed either of the following: (1) 98.75 percent for loans over $50,000 (for loans less than $50,000, the buyer must contribute 3 percent of the sales price to the down payment and closing cost) (1.25 percent down), or (2) 97.75 percent of the sales price or appraised value, for loans over $50,000 (2.25 percent down). If the purchase price exceeds the FHA-appraised value, the buyer may pay the difference in cash as part of the down payment. In addition, the FHA has set maximum loan amounts for various regions of the country. In all cases, the purchaser must contribute 3 percent of the sales price to the transaction, either in down payment or closing costs.

Other types of FHA loans are available, including one-year adjustable-rate mortgages, home improvement and rehabilitation loans, and loans for the purchase of condominiums. Specific standards for condominium complexes and the ratio of owner-occupants to renters must be met for a loan on a condominium unit to be financed through the FHA insurance programs.

Although lenders can charge interest until the next payment due date on an FHA payoff, lenders may not deny the assumption of the mortgage by a qualified buyer even if the interest rates have skyrocketed.

MATH CONCEPTS DETERMINING LTV

If a property has an appraised value of $100,000, secured by a $90,000 loan, the LTV is 90 percent:

$90,000 / $100,000 = 90%

IN PRACTICE The FHA sets lending limits for single-unit and multiple-unit properties. The limits vary significantly, depending on the average cost of housing in different regions of the country. In addition, the FHA changes its regulations for various programs from time to time. On you to do list as a new real estate agent is to establish contact your local FHA office or mortgage lender for loan amounts in your area and for specific loan requirements.

Prepayment privileges. A borrower may repay an FHA-insured loan on a one-family to four-family residence without penalty. For loans made before August 2, 1985, the borrower must give the lender written notice of intention to exercise the prepayment privilege at least 30 days before prepayment. If the borrower fails to provide the required notice, the lender has the option of charging up to 30 days' interest. For loans initiated after August 2, 1985, no written notice of prepayment is required.

Assumption rules. The assumption rules for FHA-insured loans vary, depending on the dates the loans were originated, as follows:

► FHA loans originating before December 1986, generally have no restrictions on their assumptions.

► For an FHA loan originating between December 1, 1986, and December 15, 1989, a creditworthiness review of the prospective assumer is required. If the original loan was for the purchase of a principal residence, this review is required during the first 12 months of the loan's existence. If the original loan was for the purchase of an investment property, the review is required during the first 24 months of the loan.

► For FHA loans originating on December 15, 1989, and later, no assumptions are permitted without complete buyer qualification.

Discount points. The lender of an FHA-insured loan may charge discount points in addition to a loan origination fee. The payment of points is a matter of negotiation between the seller and the buyer. However, if the seller pays more than 6 percent of the costs normally paid by the buyer (such as discount points, the loan origination fee, the mortgage insurance premium, buydown fees, pre-paid items, and impound or escrow amounts), the lender will treat the payments as a reduction in sales price and recalculate the mortgage amount accordingly.

VA-Guaranteed Loans

The Department of Veterans Affairs (usually referred to simply as VA) is authorized to guarantee loans to purchase or construct homes for eligible veterans and their spouses (including unremarried spouses of veterans whose deaths were service-related). The VA also guarantees loans to purchase mobile homes and plots on which to place them. A veteran who meets any of the following time-in-service criteria is eligible for a VA loan:

► 90 days of active service for veterans of World War II, the Korean War, the Vietnam conflict, and the Persian Gulf War

► A minimum of 181 days of active service during interconflict periods between July 26, 1947, and September 6, 1980

► Two full years of service during any peacetime period after September 7, 1980

► Six or more years of continuous duty as a reservist in the Army, Navy, Air Force, Marine Corps, Coast Guard, or as a member of the Army or Air National Guard

The VA assists veterans in financing the purchase of homes with little or no down payments at market interest rates. The VA issues rules and regulations that set forth the qualifications, limitations and conditions under which a loan may be guaranteed.

Like the term FHA loan, VA loan is something of a misnomer. The VA does not normally lend money; it guarantees loans made by lending institutions approved by the agency. The term VA loan refers to a loan that is not made by the agency but is guaranteed by it.

There is no VA dollar limit on the amount of the loan a veteran can obtain; this is determined by the lender and qualification of the buyer. The VA limits the amount of the loan it will guarantee.

IN PRACTICE The current VA loan guarantee maximum amount is $60,000. Typically, lenders will loan up to four times the veteran's available guarantee amount. The maximum loan now available to a qualified veteran, then, would be $240,000.

To determine what portion of a mortgage loan the VA will guarantee, the veteran must apply for a certificate of eligibility. This certificate does not mean that the veteran automatically receives a mortgage. It merely sets forth the maximum guarantee to which the veteran is entitled. For individuals with full eligibility, no down payment is required for a loan up to the maximum guarantee limit.

The VA also issues a certificate of reasonable value (CRV) for the property being purchased. The CRV states the property's current market value based on a VA-approved appraisal. The CRV places a ceiling on the amount of a VA loan allowed for the property. If the purchase price is greater than the amount cited in the CRV, the veteran may pay the difference in cash. The CRV is based on an appraisal. New VA regulations allow only one active VA loan at a time, and a veteran may own only two properties acquired using VA loan benefits. However, a veteran may use his or her VA benefits as many times as he or she chooses, as long as the previous benefit use has been paid.

The VA borrower pays a loan origination fee to the lender, as well as a funding fee (2 percent to 3 percent, depending on the down payment amount) to the Department of Veterans Affairs. The funding fee depends on whether it is first time use (2 percent) or a subsequent use (3 percent). Reservists and National Guard veterans pay higher funding fees. Reasonable discount points may be charged on a VA-guaranteed loan, and either the veteran or the seller may pay them.

Prepayment privileges. As with an FHA loan, the borrower under a VA loan can prepay the debt at any time without penalty.

Assumption rules. VA loans made before March 1, 1988, are freely assumable, although an assumption processing fee will be charged. The fee is usually $500. For loans made on or after March 1, 1988, the VA must approve the buyer and assumption agreement. The original veteran borrower remains personally liable for the repayment of the loan unless the VA approves a release of liability. The release of liability will be issued by the VA only if

► the buyer assumes all of the veteran's liabilities on the loan and

► the VA or the lender approves both the buyer and the assumption agreement.

A release also would be possible if another veteran used his or her own entitlement in assuming the loan.

IN PRACTICE A release of liability issued by the VA does not release the veteran's liability to the lender. This must be obtained separately from the lender. Real estate licensees should contact their local mortgage lenders for specific requirements for obtaining or assuming VA-insured loans. The programs change from time to time. For more information visit the VA.gov and for home loans go to http://www.benefits.va.gov/homeloans/

Agriculture Loan Programs

The Farm Service Agency (FSA), formerly the Farmers Home Administration, is a federal agency of the Department of Agriculture. The FSA offers programs to help families purchase or operate family farms. Through the Rural Housing and Community Development Service (RHCDS), it also provides loans to help families purchase or improve single-family homes in rural areas (generally areas with populations of fewer than 10,000). Loans are made to low-income and moderate-income families, and the interest rate charged can be as low as 1 percent, depending on the borrower's income. The FSA provides assistance to rural and agricultural businesses and industry through the Rural Business and Cooperative Development Service (RBCDS).

FSA loan programs fall into two categories: guaranteed loans, made and serviced by private lenders and guaranteed for a specific percentage by the FSA, and loans made directly by the FSA.

The Farm Credit System (System) provides loans to more than a half million borrowers, including farmers, ranchers, rural homeowners, agricultural cooperatives, rural utility systems, and agribusinesses. Unlike commercial banks, system banks and associations do not take deposits. Instead, loanable funds are raised through the sale of Systemwide bonds and notes in the nation's capital markets.

A good source of information regarding farm loans is the US Department of Agriculture Farm Service Agency. There Web site is here: www.fsa.usda.gov

Farmer Mac (formerly the Federal Agricultural Mortgage Corporation, or FAMC), is an agency that operates similarly to Fannie Mae and Freddie Mac in a context of agricultural loans. It provides a secondary market for farm loans by guaranteeing mortgage-backed securities based on pools of these loans. Farmer Mac pools or bundles agricultural loans from the original lenders and issues guaranteed mortgage-backed securities based on its own loan pools.

In recent years, there have been many changes in all of the agricultural lending programs. Since 1994, the Farmer's Home Administration, the Rural Development Administration, the Rural Electrification Administration, and the Agricultural Cooperative Service have been combined into the USDA Rural Development Agency. More information can be found by going to there Web site under the US Department of Agriculture here www.rurdev.usda.gov

OTHER FINANCING TECHNIQUES

Because borrowers often have different needs, a variety of other financing techniques have been created. Other techniques apply to various types of collateral. The following pages consider some of the loans that do not fit into the categories previously discussed.

Purchase-Money Mortgage (PMMs)

A purchase-money mortgage (PMM) is a note and mortgage created at the time of purchase. Its purpose is to make the sale possible. The term is used in two ways. First, it may refer to any security instrument that originates at the time of sale. More often, it refers to the instrument given by the purchaser to a seller who takes back a note for part or all of the purchase price. The mortgage may be a first or a junior lien, depending on whether prior mortgage liens exist.

FOR EXAMPLE Ben wants to buy Brownacre for $200,000. Ben has a $40,000 down payment and agrees to assume an existing mortgage of $80,000. Because Ben might not qualify for a new mortgage under the circumstances, the owner agrees to take back a purchase-money second mortgage in the amount of $80,000. At the closing, Ben will execute a mortgage and note in favor of the owner, who will convey title to Ben.

Package Loans

A package loan includes not only the real estate, but also all personal property and appliances installed on the premises. In recent years, this kind of loan has been used extensively to finance furnished condominium units. Package loans usually include furniture, drapes, carpets, and the kitchen range, refrigerator, dishwasher, garbage disposal, washer, dryer, food freezer, and other appliances as part of the sales price of the home.

Blanket Loans

A blanket loan covers more than one parcel or lot. It is usually used to finance sub-division developments. However, it can finance the purchase of improved properties or consolidate loans as well. A blanket loan usually includes a provision known as a partial release clause. This clause permits the borrower to obtain the release of any one lot or parcel from the blanket lien by repaying a certain amount of the loan. The lender issues a partial release for each parcel released from the mortgage lien. The release form includes a provision that the lien will continue to cover all other unreleased lots.

A wraparound loan enables a borrower with an existing mortgage or deed of trust loan to obtain additional financing from a second lender without paying off the first loan. The second lender gives the borrower a new, increased loan at a higher interest rate and assumes payment of the existing loan. The total amount of the new loan includes the existing loan as well as the additional funds needed by the borrower. The borrower makes payments to the new lender on the larger loan. The new lender makes payments on the original loan out of the borrower's payments.

Wraparound Loans

A wraparound mortgage can be used to refinance real property or to finance the purchase of real property when an existing mortgage cannot be prepaid. The buyer executes a wraparound mortgage to the seller or lender, who collects payments on the new loan and continues to make payments on the old loan. It also can finance the sale of real estate when the buyer wishes to invest a minimum amount of initial cash. A wraparound loan is possible only if the original loan permits it. For instance, an acceleration and alienation or a due-on-sale clause in the original loan documents may prevent a sale under a wraparound loan.

IN PRACTICE To protect themselves against a seller's default on a previous loan, buyers should require that protective clauses be included in any wraparound document to grant buyers the right to make payments directly to the original lender.

Open-End Loans

An open-end loan secures a note executed by the borrower to the lender. It also secures any future advances of funds made by the lender to the borrower. The interest rate on the initial amount borrowed is fixed, but interest on future advances may be charged at the market rate in effect. An open-end loan is often a less costly alternative to a home improvement loan. It allows the borrower to "open" the mortgage or deed of trust to increase the debt to its original amount, or the amount stated in the note, after the debt has been reduced by payments over a period of time. The mortgage usually states the maximum amount that can be secured, the terms and conditions under which the loan can be opened, and the provisions for repayment.

Construction Loans

A construction loan is made to finance the construction of improvements on real estate such as homes, apartments, and office buildings. The lender commits to the full amount of the loan but disburses the funds in payments during construction. These payments are also known as draws. Draws are made to the general contractor or the owner for that part of the construction work that has been completed since the previous payment. Before each payment, the lender inspects the work. The general contractor must provide the lender with adequate waivers that release all mechanic's lien rights for the work covered by the payment.

This kind of loan generally bears a higher-than-market interest rate because of the risks assumed by the lender. These risks include the inadequate releasing of mechanics' liens, possible delays in completing the construction, or the financial failure of the contractor or subcontractors. Construction loans are generally short-term or interim financing. The borrower pays interest only on the monies that have actually been disbursed. The borrower is expected to arrange for a permanent loan, also known as an end loan or take-out loan, that will repay or "take out" the construction financing lender when the work is completed. Some lenders now offer construction-to-permanent loans that become fixed mortgages upon completion. Participation financing is when a lender demands an equity position in the project as a requirement for the loan.

Sale-and-Leaseback

Sale-and-leaseback arrangements are used to finance large commercial or industrial properties. The land and building, usually used by the seller for business purposes, are sold to an investor. The real estate then is leased back by the investor to the seller, who continues to conduct business on the property as a tenant. The buyer becomes the lessor, and the original owner becomes the lessee. This enables a business to free money tied up in real estate to be used as working capital.

Sale-and-leaseback arrangements involve complicated legal procedures, and their success is usually related to the effects the transaction has on the firm's tax situation. Legal and tax experts should be involved in this type of transaction.

Buydowns

A buydown is a way to temporarily (or permanently) lower the interest rate on a mortgage or deed of trust loan. Perhaps a homebuilder wishes to stimulate sales by offering a lower-than-market rate. Or a first-time residential buyer may have trouble qualifying for a loan at the prevailing rates; relatives or the sellers might want to help the buyer qualify. In any case, a lump sum is paid in cash to the lender at the closing. The payment offsets (and so reduces) the interest rate and monthly payments during the mortgage's first few years. Typical buydown arrangements reduce the interest rate by 1 percent to 2 percent over the first one to two years of the loan term. After that, the rate rises. The assumption is that the borrower's income will also increase and that the borrower will be more able to absorb the increased monthly payments. In a permanent buydown, a larger upfront payment reduces the effective interest rate for the life of the loan.

Home Equity Loans

Using the equity buildup in a home to finance purchases is an alternative to refinancing. Home equity loans are a source of funds for homeowners to use for a variety of financial needs, including the following:

► To finance the purchase of expensive items

► To consolidate existing installment loans or credit card debt

► To pay medical, education, home improvement, or other expenses

The original mortgage loan remains in place; the home equity loan is junior to the original lien. If the homeowner completely refinances, the original mortgage loan and the home equity loan are paid off and replaced by a new loan. (This strategy is an alternative way to borrow the equity and is not really a home equity loan.)

IN PRACTICE A home equity loan can be taken out as a fixed loan amount or as an equity line of credit. With the home equity line of credit, the lender extends a line of credit that the borrower can use whenever he or she wants. The borrower receives the money by a check sent to him or her, by deposits made in a checking or savings account, or by a book of drafts the borrower can use up to his or her credit limit.

The homeowner must consider a number of factors before deciding on a home equity loan, including

► the costs involved in obtaining a new mortgage loan or a home equity loan,

► current interest rates,

► total monthly payments, and

► income tax consequences.

Once the loan process has reached the point at which the borrowers' financial capability has been approved, the collateral's appraisal value is acceptable, and the legal title is clear, the loan is approved. At closing, a statement is prepared allocating credits and charges to the appropriate parties. Included in the prorations are loan interest, property taxes, insurance premiums, and rents and special assessments if applicable. Costs include points, placement fees, impound funds (escrows), mortgage insurance premium, credit report, appraisal fee, and escrow charges. After the final documents are signed and recorded, the monies are paid completing the process. (See Chapter 22.)

FINANCING LEGISLATION

The federal government regulates the lending practices of mortgage lenders through the Truth-in-Lending Act, the Equal Credit Opportunity Act, the Community Reinvestment Act of 1977, and the Real Estate Settlement Procedures Act.

Truth-in-Lending Act and Regulation Z

Regulation Z, which was promulgated pursuant to the Truth-in-Lending Act by the Federal Trade Commission (FTC), requires that credit institutions inform borrowers of the true cost of obtaining credit. Its purpose is to enable borrowers to compare the costs of various lenders and avoid the uninformed use of credit. Regulation Z applies when credit is extended to individuals for personal, familial or household uses. The amount of credit sought must be $25,000 or less. Regardless of the amount, however, Regulation Z generally applies when a credit transaction is secured by a residence. The regulation does not apply to business or commercial loans or to agricultural loans of more than $25,000. (So if an investor purchased a residential property for commercial purposes, Regulation Z would not apply.)

Under the Truth-in-Lending Act, a consumer must be fully informed of all finance charges and the true interest rate before a transaction is completed. The finance charge disclosure must include any loan fees, finder's fees, service charges and points, as well as interest. In the case of a mortgage loan made to finance the purchase of a dwelling, the lender must compute and disclose the annual percentage rate (APR). However, the lender does not have to indicate the total interest payable during the term of the loan. Also, the lender does not have to include actual costs such as title fees, legal fees, appraisal fees, credit reports, survey fees, and closing expenses as part of the finance charge. (See Chapter 22.)

Creditor. A creditor, for purposes of Regulation Z, is any person who extends consumer credit more than 25 times each year or more than 5 times each year if the transactions involve dwellings as security. The credit must be subject to a finance charge or payable in more than four installments by written agreement.

Three-day right of rescission. In the case of most consumer credit transactions covered by Regulation Z, the borrower has three days in which to rescind the transaction by merely notifying the lender. This right of rescission does not apply to owner-occupied residential purchase-money or first mortgage or deed of trust loans. It does, however, apply to refinancing a home mortgage or to a home equity loan. In an emergency, the right to rescind may be waived in writing to prevent a delay in funding.

Advertising. Regulation Z provides strict regulation of real estate advertisements (in all media, including newspapers, flyers, signs, billboards, Web sites, radio or television ads, and direct mailings) that refer to mortgage financing terms. General phrases like "liberal terms available" may be used, but if details are given, they must comply with the act. The annual percentage rate (APR)—which is calculated based on all charges rather than the interest rate alone—must be stated.

Advertisements for buydowns or reduced-interest rate mortgages must show both the limited term to which the interest rate applies and the annual percentage rate. If a variable-rate mortgage is advertised, the advertisement must include

► the number and timing of payments,

► the amount of the largest and smallest payments, and

► a statement of the fact that the actual payments will vary between these two extremes.

Specific credit terms, such as down payment, monthly payment, dollar amount of the finance charge, or term of the loan, are referred to as trigger terms, and may not be advertised unless the advertisement includes the following information:

► Cash price

► Required down payment

► Number, amounts, and due dates of all payments

► Annual percentage rate

► Total of all payments to be made over the term of the mortgage (unless the advertised credit refers to a first mortgage or deed of trust to finance the acquisition of a dwelling)

Penalties. Regulation Z provides penalties for noncompliance. The penalty for violation of an administrative order enforcing Regulation Z is $10,000 for each day the violation continues. A fine of up to $10,000 may be imposed for engaging in an unfair or a deceptive practice. In addition, a creditor may be liable to a consumer for twice the amount of the finance charge, for a minimum of $100 and a maximum of $1,000, plus court costs, attorney's fees, and any actual damages. Willful violation is a misdemeanor punishable by a fine of up to $5,000, one year's imprisonment, or both.

Equal Credit Opportunity Act

The federal Equal Credit Opportunity Act (ECOA) prohibits lenders and others who grant or arrange credit to consumers from discriminating against credit applicants on the basis of

► race,

► color,

► religion,

► national origin,

► sex,

► marital status,

► age (provided the applicant is of legal age), or

► dependence on public assistance.

In addition, lenders and other creditors must inform all rejected credit applicants of the principal reasons for the denial or termination of credit. The notice must be provided in writing, within 30 days. The federal ECOA also provides that a borrower is entitled to a copy of the appraisal report if the borrower paid for the appraisal.

Community Reinvestment Act of 1977 (CRA)

Community reinvestment refers to the responsibility of financial institutions to help meet their communities' needs for low-income and moderate-income housing. In 1977, Congress passed the Community Reinvestment Act of 1977 (CRA). Under the CRA, financial institutions are expected to meet the deposit and credit needs of their communities; participate and invest in local community development and rehabilitation projects; and participate in loan programs for housing, small businesses, and small farms.

The law requires any federally supervised financial institution to prepare a statement containing

► a definition of the geographic boundaries of its community;

► an identification of the types of community reinvestment credit offered, such as residential housing loans, housing rehabilitation loans, small-business loans, commercial loans, and consumer loans; and

► comments from the public about the institution's performance in meeting its community's needs.

Financial institutions are periodically reviewed by one of four federal financial supervisory agencies: the Comptroller of the Currency, the Federal Reserve's Board of Governors, the Federal Deposit Insurance Corporation, or the Office of Thrift Supervision. The institutions must post a public notice that their community reinvestment activities are subject to federal review, and they must make the results of these reviews public.

Real Estate Settlement Procedures Act

The federal Real Estate Settlement Procedures Act (RESPA) applies to any residential real estate transaction involving a new first mortgage loan. RESPA is designed to ensure that buyer and seller are both fully informed of all settlement costs. This important federal law is discussed in detail in Chapter 22.

COMPUTERIZED LOAN ORIGINATION AND AUTOMATED UNDERWRITING

A computerized loan origination (CLO) system is an electronic network for handling loan applications through remote computer terminals linked to several lenders' computers. With a CLO system, a real estate broker or salesperson can call up a menu of mortgage lenders, interest rates, and loan terms, then help a buyer select a lender and apply for a loan right from the brokerage office.

The licensee may assist the applicant in answering the on-screen questions and in understanding the services offered. The broker in whose office the terminal is located may earn fees of up to one half point of the loan amount. The borrower, not the mortgage broker or lender, must pay the fee. The fee amount may be financed, however. While multiple lenders may be represented on an office's CLO computer, consumers must be informed that other lenders are available. An applicant's ability to comparison shop for a loan may be enhanced by a CLO system; the range of options may not be limited. One-stop shopping real estate services and federal regulation pertaining to CLOs are discussed in Chapter 22.

On the lenders' side, new automated underwriting procedures can shorten loan approvals from weeks to minutes. Automated underwriting also tends to lower

the cost of loan application and approval by reducing lenders' time spent on the approval process by as much as 60 percent. Freddie Mac uses a system called Loan Prospector. Fannie Mae has a system called Desktop Underwriter that reduces approval time to minutes, based on the borrower's credit report, a paycheck stub, and a drive-by appraisal of the property. Complex or difficult mortgages can be processed in less than 72 hours. Through automated underwriting, one of a borrower's biggest headaches in buying a home—waiting for loan approval—is eliminated. In addition, a prospective buyer can strengthen his or her purchase offer by including proof of loan approval.

Scoring and Automated Underwriting. Lenders have been using credit scoring systems to predict prospective borrowers' likelihood of default for many years. When used as a part of traditional "manual" evaluation of applicants, credit scoring provides a useful objective standard against which to balance the loan officer's more subjective professional judgment. When used in automated underwriting systems, however, the application of credit scores has become somewhat controversial. Critics of scoring are concerned that they may not be accurate or fair, and, in the absence of human discretion, could result in making it more difficult for low-income and minority borrowers to obtain mortgages.

Here's what Freddie Mac has to say:

Whether using traditional or automated methods, underwriters must consider all three areas of underwriting—collateral, credit reputation, and capacity. When reviewing collateral, underwriters look at house value, down payment, and property type. Income, debt, cash reserves, and product type are considered when underwriters are looking at capacity. Credit scores are simply one consideration when underwriters are reviewing credit reputation. Even lenders who use an automated underwriting system such as Loan Prospector, still rely on human judgment when the scoring system indicates that the loan application is a higher risk.

IN PRACTICE Recently, Fannie Mae and Freddie Mac have committed themselves to moving away from credit scoring in favor of their own underwriting criteria. Computerized origination systems have become more sophisticated and are making this possible.

SUMMARY

The federal government affects real estate financing money and interest rates through the Federal Reserve Board's discount rate and reserve requirements; it also participates in the secondary mortgage market. The secondary market is generally composed of the investors who ultimately purchase and hold the loans as investments. These include insurance companies, investment funds, and pension plans.

Types of loans include fully amortized and straight loans as well as adjustable-rate mortgages, growing-equity mortgages, balloon payment mortgages, and reverse-annuity mortgages.

Many mortgage and deed of trust loan programs exist, including conventional loans and those insured by the FHA or private mortgage insurance companies or guaranteed by the VA. FHA and VA loans must meet certain requirements for the borrower to obtain the benefits of government backing, which induces the lender to lend its funds. In certain market conditions the interest rates for these loans may be lower than those charged for conventional loans. Lenders may also charge points.

Other types of real estate financing include seller-financed purchase-money mortgages or deeds of trust, blanket mortgages, package mortgages, wraparound mortgages, open-end mortgages, construction loans, sale-and-leaseback agreements, and home equity loans.

Regulation Z, implementing the federal Truth-in-Lending Act, requires that lenders inform prospective borrowers who use their homes as security for credit of all finance charges involved in such loans. Severe penalties are provided for noncompliance. The federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, or dependence on public assistance. The Real Estate Settlement Procedures Act requires that lenders inform both buyers and sellers in advance of all fees and charges required for the settlement or closing of residential real estate transactions.